A Testamentary Trust is a trust established pursuant to a will which comes into effect after the will-maker dies. Instead of passing the assets directly to individual beneficiaries, the Executor puts the assets into a Testamentary Discretionary Trust.

There are several advantages to a Testamentary Trust Will which are not available under a Standard Will, such as asset protection, advantageous tax treatment and flexibility. This article focuses on Advantageous tax treatment. You can read my previous article on the Testamentary Trust structure generally and its benefit: What is a Testamentary Trust, and should you have one?

Income Tax Benefits

A Testamentary Trust has an important tax advantage, in that it allows the trustee to split income generated from the Testamentary Trust among the trust’s discretionary beneficiaries in a way that minimises the overall tax paid on the trust’s income.

The trustee can exercise their discretion to decide which beneficiaries receive trust income. The trust income is subsequently included in the beneficiaries' personal assessable income, which is taxed at their own marginal tax rate. This means that the trustee can maximise the net trust income by streaming income to beneficiaries with low marginal tax rates such as minors, students and spouses who do not work or have lower incomes.

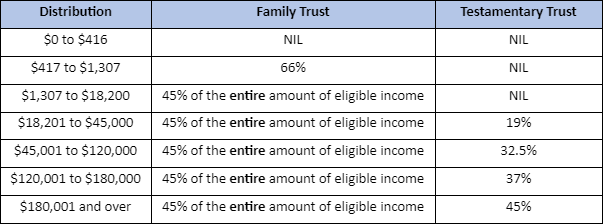

Additionally, Testamentary Trusts benefit from special rules called “Exempt Trust Income” which allow minor beneficiaries of a trust to receive the full adult tax-free threshold each year. This means that minor children are taxed at individual rates (about $18,200 tax-free and the balance at normal adult rates). By comparison, a distribution from an ordinary Family Trust (not forming part of your will) to a minor is taxed at penalty rates.

See the table below:

The current resident minors tax rates: Family Trust VS Testamentary Trust

*Based on FY22 rates & these rates do not include the Medicare Levy.

Case Study 1

Matthew’s wife passed away many years ago.

Matthew only has one adult child, Jane. Jane has 3 minor children.

Jane is a pharmacist and earns $130,000 per annum.

Matthew’s only significant asset is his family home, which is a contemporary 3-bedroom house worth approx. $1,500,000.

Matthew decides to leave everything to Jane.

Jane owns a 3-bedroom townhouse.

Once Matthew passes away and the house is transferred to Jane, Jane will rent out the house as an investment property, which brings in approx. $50,000 p.a. in rental income.

Standard Will - Without a Testamentary Trust

Under a Standard Simple Will, Matthew’s house will be transferred to Jane individually as she is the sole beneficiary. When combined with her current annual income of $130,000 from her employment, the additional $50,000 in rental income will be taxed in the tax bracket of $120,001 to $180,000, at a rate of 37%. The tax payable on the rental income of $50,000 is $18,500. After tax, Jane will only be left with $31,500.

Testamentary Trust Will

Under a Testamentary Trust Will, Matthew’s Will creates a Testamentary Trust which is controlled by Jane. The property will be transferred to the Testamentary Trust and will produce the same return of $50,000.

Jane can stream the additional $50,000 in rental income to her 3 minor children, splitting it equally between them (i.e. $16,667 each). Her children will not need to pay any tax as the income is below the tax-free threshold.

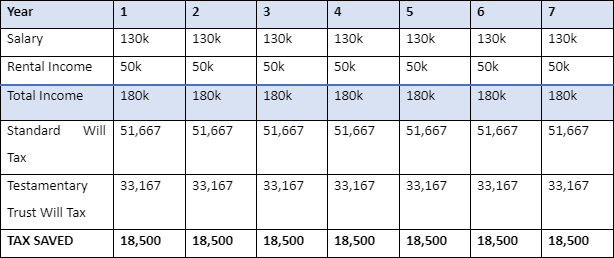

This case study illustrates that in just one year, Jane can save $18,500 by using a Testamentary Trust.

Ignoring the effects of compounding, over a 7-year period Jane can save a total of $129,500 in unnecessary tax as demonstrated in the table below.

Capital Gains Tax

In addition, capital gains received from assets of a Testamentary Trust can also be streamed to one or more beneficiaries to effectively minimise tax.

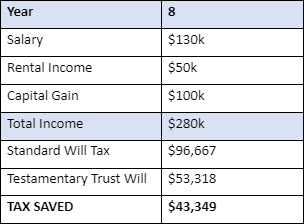

Take Jane and Mathew again. If Jane holds Matthew’s house for 8 years and then sells it for $1.7M, the sale will incur a capital gain of $200,000.

Under a Standard Simple Will, both the $50k rent + $100k capital gain (after the 50% CGT discount applied) will be added to Jane’s taxable income for the year, bringing her total taxable income to $280,000, and placing her into the top tax bracket of 45%.

Under a Testamentary Trust Will, Jane can stream the $150k to her 3 minor children, splitting it equally between them (i.e. $50,000 each). Each child will be required to pay only $6,717 in tax.

The result is that, in the eighth year, Jane will save another $43,349 by using a Testamentary Trust.

Please note the above examples are for illustrative purposes only and all estate planning solutions need to be tailored to your personal circumstances. If you would like to speak with one of the solicitors in our award-winning estate planning team, please do not hesitate to contact us.

Article by Connie Ung.

E: ConnieUng@robbinswatson.com.au

P: (07) 5576 9999

Connie is a solicitor practising predominantly estate planning and deceased estate administration, at Robbins Watson Solicitors. See her full profile here:

https://robbinswatson.com.au/our-people/connie-ung